LIC Kanyadaan Policy: Every parent harbors the same wish in their heart: that their daughter’s future be secure, happy, and free from worries. From the time their daughter is young, parents begin to worry about her education, marriage, and future dreams.

In today’s world of rapidly rising inflation, simply earning money through hard work is not enough; investing in the right plan at the right time becomes crucial. Keeping this in mind, LIC (Life Insurance Corporation of India) has introduced a plan commonly known as the Kanyadaan Policy.

What is the LIC Kanyadaan Policy and why is it special?

The LIC Kanyadaan Policy is specifically designed for parents who want to secure their daughter’s financial future. This policy creates a secure fund for major expenses such as their daughter’s education and marriage. The most significant feature of this plan is that it allows for investment with a very small amount. Many people start this policy with as little as ₹1000 and build a substantial fund over time.

This policy is not only a means of saving but also provides insurance coverage. This means that if the family faces any financial difficulties in the future, their daughter’s education or marriage will not be affected.

How does a small amount grow into a large sum?

Investment in this policy is made for the long term. When parents start this plan during their daughter’s childhood, they benefit fully from the power of compounding. By depositing small amounts every month or year, a large sum is accumulated, which comes in handy when the daughter grows up.

This is why people consider it the foundation of their daughter’s dreams. A decision made at the right time provides immense relief in the years to come.

Why is this plan trustworthy for parents?

LIC is one of the most trusted insurance companies in India. For years, people have entrusted their savings and future security to LIC. The Kanyadaan Policy is also a part of that trust.

Investing in it not only provides a maturity amount but also offers insurance coverage, providing security to the family. The biggest advantage of this plan is that it takes into account both emotions and the future. It provides the assurance of fulfilling a daughter’s dreams and brings peace of mind to parents.

Give your daughter’s dreams a strong foundation

Today’s daughters are excelling in every field. Some want to become doctors, some engineers, and others want to stand on their own two feet and achieve something great. Making their path easier is the responsibility of the parents. This LIC plan makes that responsibility easier.

If you start investing at the right age, you won’t need to depend on others for your daughter’s education, marriage, or any other major expenses.

A final thought from the heart

A daughter is not a burden, but the future. And securing her future is the greatest wisdom. LIC’s Kanyadaan Policy can be a strong support for those parents who, even with limited income, want to give their daughters the courage to dream big. A small decision taken at the right time can make tomorrow incredibly beautiful.

Disclaimer: This article is for general information purposes only. The terms, benefits, and investment amounts associated with LIC’s Kanyadaan Policy may change over time. Before making any investment, please obtain complete information from LIC’s official website or an authorized agent. The author will not be responsible for any financial losses.

Also read:

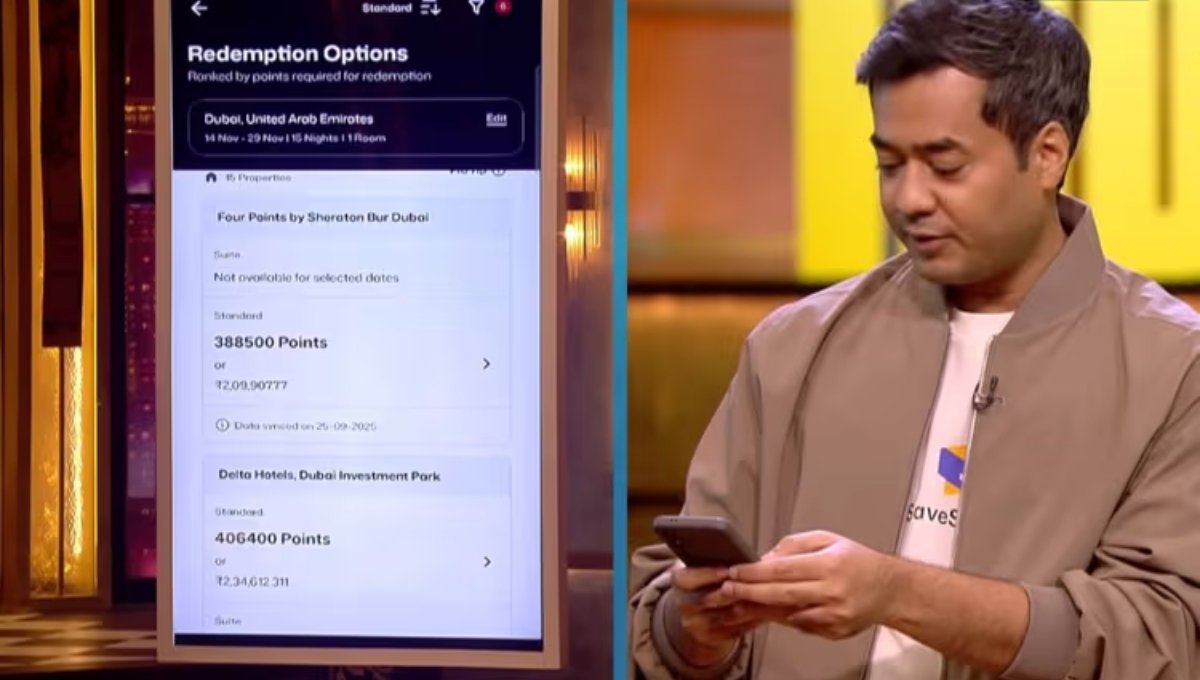

Shark Tank India: SaveSage Wins ₹4 Crore Funding With Smart Credit Card Rewards Idea

FPIs Sell ₹33,598 Crore in January: Is Foreign Investor Sentiment Turning Negative?

PM Modi Distributes: 61,000 Job Letters at Rozgar Mela, Highlights Global Opportunities