Post Office SCSS: There comes a point in life when, after years of hard work, all a person wants is peace of mind. Waking up without an alarm clock, spending time with family, and doing all the things that were left undone during their working years. But as retirement approaches, a worry creeps in how will the monthly expenses be met?

With inflation constantly rising, a secure and reliable source of income becomes absolutely essential. Understanding this need, the government has launched the Post Office Senior Citizen Savings Scheme (SCSS). This scheme is designed for those who want a fixed monthly income after retirement without any risk.

What is the Post Office SCSS scheme?

The Post Office Senior Citizen Savings Scheme is a scheme fully supported by the Government of India. This means that the money invested is completely safe. The aim of this scheme is to provide retired individuals with a stable and reliable income so that they don’t have to depend on anyone for their expenses.

Currently, SCSS offers an annual interest rate of 8.2 percent, which is significantly better than other savings schemes. The best part is that the interest is credited directly to your account every three months, ensuring a regular income.

How to get ₹20,500 every month?

If a person invests the maximum amount in this scheme, they can earn approximately ₹20,500 per month. This amount is very helpful for those who want a secure income in addition to their pension.

In this scheme, money is deposited for a fixed period, and the interest earned on it is completely fixed. This means that whether the market goes up or down, your income remains unaffected.

Why is this scheme the most reliable after retirement?

The biggest concern after retirement is the security of one’s money. The stock market or mutual funds are subject to fluctuations, which is not suitable for everyone. But there is no such risk with SCSS because it is a government-backed scheme.

In addition, it also offers some tax benefits, making the investment even more advantageous. This is why millions of senior citizens across the country trust this scheme.

Who can invest in this scheme?

This scheme is specifically designed for people aged 60 years and above. However, under certain conditions, retired individuals between the ages of 55 and 60 can also invest in it. An account can be opened at a post office or an authorized bank, and the entire process is very simple.

A strong step towards a secure future

If you want to live a comfortable life after retirement, avoid being dependent on your children, and receive a fixed amount every month, then the Post Office SCSS scheme can be an excellent option for you.

It provides not only financial security but also peace of mind.: In today’s times, when everyone is looking for safe investment options, this scheme is a boon for senior citizens.

Disclaimer: This article is for general informational purposes only. The interest rate, rules, and regulations of the Post Office Senior Citizen Savings Scheme may be changed by the government from time to time. Before investing, please obtain complete information from your nearest post office or the official website. The author will not be responsible for any financial loss.

Also read:

RBI Report: Why India’s State Fiscal Deficit Rose to 3.3% of GDP

PM Modi Distributes: 61,000 Job Letters at Rozgar Mela, Highlights Global Opportunities

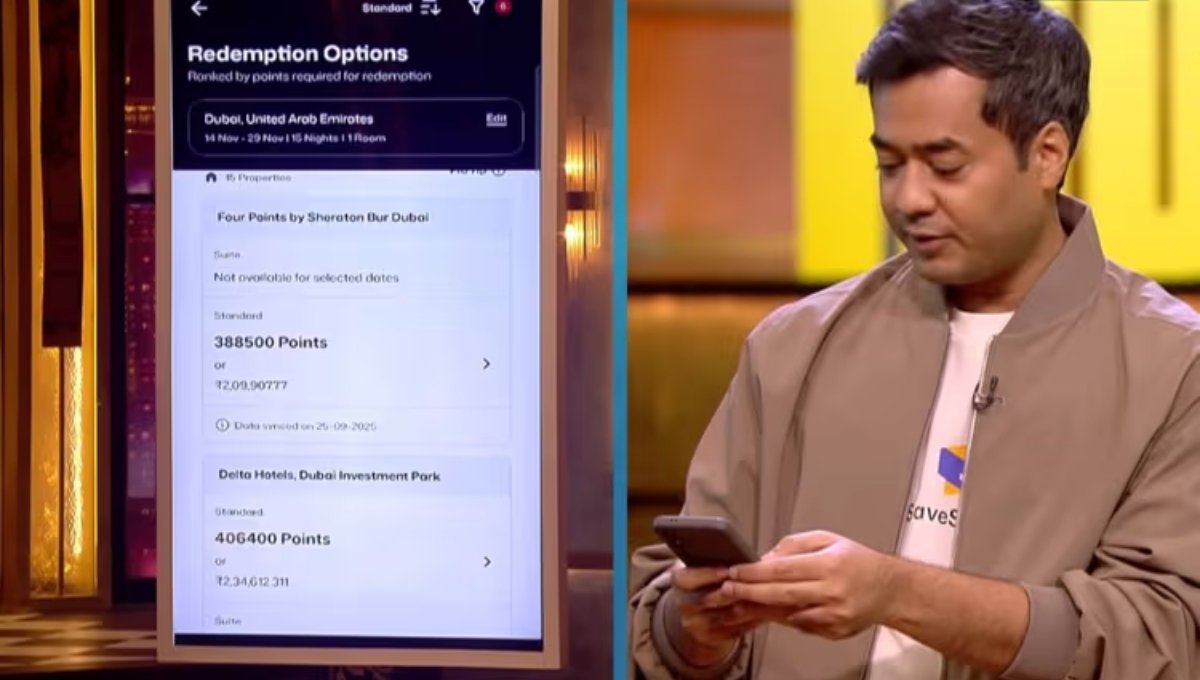

Shark Tank India: SaveSage Wins ₹4 Crore Funding With Smart Credit Card Rewards Idea