Budget 2026 Update: Friends, the moment we hear the word “budget,” a multitude of questions arise in our minds. Some worry about taxes, others about inflation, and some simply want to know how it will affect their wallets.

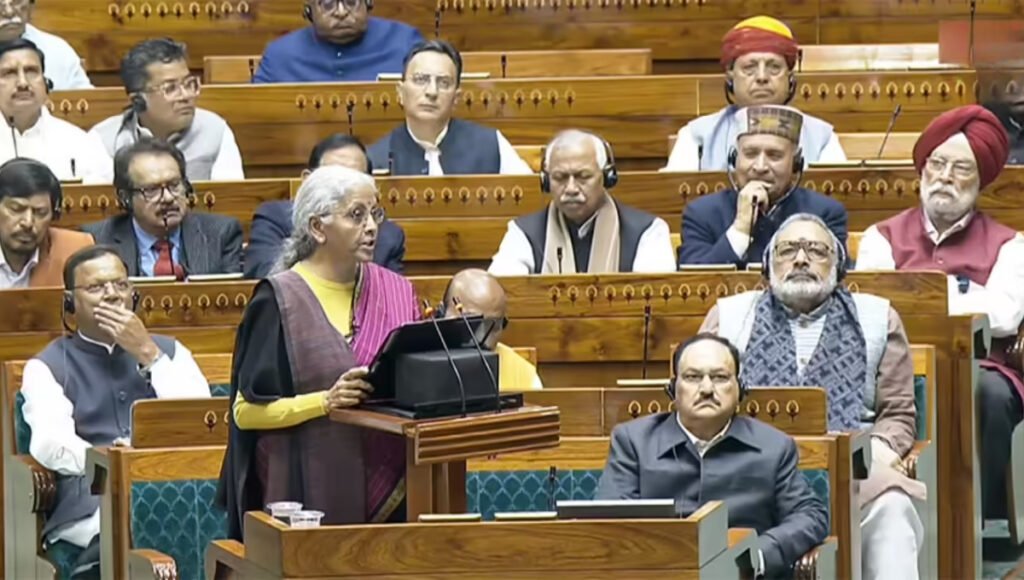

Finance Minister Nirmala Sitharaman has presented Budget 2026, but this time too, no major relief was offered to the middle class and farmers. There were no changes to the income tax slabs, which came as a disappointment to many.

What Changed and What Didn’t for Taxpayers

In this budget, the tax slabs remain unchanged. Those who were hoping for lower tax rates or an increase in the exemption limit were left disappointed.

However, the government has made approximately fifteen to seventeen changes that directly affect the lives of ordinary taxpayers. These changes may seem minor on paper, but their impact will be clearly visible in daily financial management.

The Reality Beyond the Social Media Hype

After the budget announcement, there’s a flood of videos, posts, and news reports everywhere. Some call it excellent, while others find it completely disappointing. In such an environment, finding accurate information becomes difficult.

Many people get confused by incomplete information and fail to understand what has actually changed for them. The language of the budget is often so complex that the average person cannot relate to it.

The Need for Understanding in Simple Language

In her speech, the Finance Minister explained several rules related to taxpayers in detail. The government says that some processes have been simplified to reduce the burden on people.

Several minor changes have been made, from filing returns to investment rules. The aim is said to be to make the system more transparent, but how much benefit this will actually bring on the ground remains to be seen.

Middle Class Hopes Unfulfilled

Salaried individuals had high hopes for significant relief from this budget. Amidst rising inflation, even a small tax break could have been a great help. But with the tax slabs remaining unchanged, there will be no significant impact on monthly budgets. House rent, children’s education, and daily expenses will continue to be a heavy burden on their pockets. The Situation of Farmers and Small Traders

Farmers and small traders in rural areas were also hoping for a major announcement. While some schemes were mentioned in the budget, concrete relief was scarce. The schemes may look good on paper, but the real benefit comes when the money reaches the right hands at the right time.

How to Understand the Budget

No budget can be understood simply by looking at the headlines. The rules, conditions, and procedures hidden within it tell the real story. Every taxpayer should understand the changes in relation to their own circumstances and seek advice from an expert if needed. Accurate information is crucial for sound financial planning.

The Way Forward

While Budget 2026 may not have offered significant relief, it’s also true that economic decisions take time to show their effects. It’s essential for the common man to act with prudence rather than emotion. Managing one’s expenses, savings, and investments according to the new rules is the best approach.

Disclaimer: This article is for informational purposes only. The rules and provisions related to the budget may change over time. Before making any financial decisions, please consult official documents or a qualified expert.

Also read:

Stock Market Crash on Budget Day: 5 Big Reasons Behind Market Fall

Income Tax Collection 2026: Which Country Collects the Most Tax India, US, China or Pakistan?

Education Budget 2026: India’s Big Push Toward Future, Skills and Innovation