Cyber Fraud Alert: In the modern world of digital technology, though everything is made easy, it carries a lot of threat too. UPI, Internet banking, and online transactions through mobile phones can do anything in a matter of seconds. Yet, cyber fraudsters are making the most of this.

One wrong click, a wrong call, or a wrong link, and your hard-earned savings can evaporate in a jiffy. Most often, persons panic and don’t know what to do. In such situations, very few persons are aware of the fact that the Indian government has announced a number to safe your money by calling it immediately. The number is “1930”.

What, specifically, is this 1930 helpline? And why, exactly, is it so important?

“1930” is the cybercrimes helpline number facilitated by the Government of India. This is a separate number designed specifically to tackle cybercrimes such as fraud, UPI scams, bank fraud, fake calls, and SMS scams. However, if your account has been hacked and any amount has been deducted or if anyone is trying to deduct money from your account, you should immediately ring 1930.

As and when a complaint is filed on this number, your information is conveyed to the concerned bank and the cyber cell. If a complaint is made on time, there is a high probability that the money has been frozen, and the fraudster cannot withdraw it.

How a Small Delay Can Cause a Large Financial Loss

In many cases, people think that after going to the bank, things will happen, or that everything will be all right for a while. It is due to that idea that people will develop the biggest mistake. Cyber criminals work too fast. They will move that money from one account to another within a matter of minutes.

In case you immediately contact 1930 after the fraud, the chances of finding the location of your money are greatly higher. This has helped many recover their money.

What does dialing 1930 connnect you to?

So, when your number rings, they would ask to know your important details such as your mobile number, bank, transaction, etc., how it happened, so on, after that, your complaint would be registered, and immediately they would send an alert to that bank, in case it was done recently, they can hold it. So, it must be done on time because, on hold, they can stop it.

Essential Precautions Towards Prevention of Cyber Frauds

Presently, fake callers often impersonate bank officials, customer care executives, or even police officers. They demand OTPs (One Time Passwords) citing reasons like updations in KYC documents, or threaten to activate some block on your account. Always keep in mind, none of the financial or government agencies will ask you to share anything like that on a call.

Why every Indian should remember the year 1930

Just like how 108 is important for ambulances and 112 is essential for police services, 1930 is the important number to help people tackle cyber frauds. This number will help protect your hard-earned money. This number should be kept in memory or written down at some place by every mobile user.

Closing remark from the heart

The internet world is just as convenient as it is dangerous if one is not alert. One small mistake and you will have to give away your life savings. But, on the other hand, if you’re aware and take the right steps in time, you will manage to avoid such losses.

Disclaimer: The information given in this article is for general information only. In case of any cyber frauds, complaints shall immediately be lodged at ‘1930’ or at the official cyberspace website of the Government of India. The author will hold no responsibility for any financial loss. All information should be used at your discretion after understanding it yourself.

Also read:

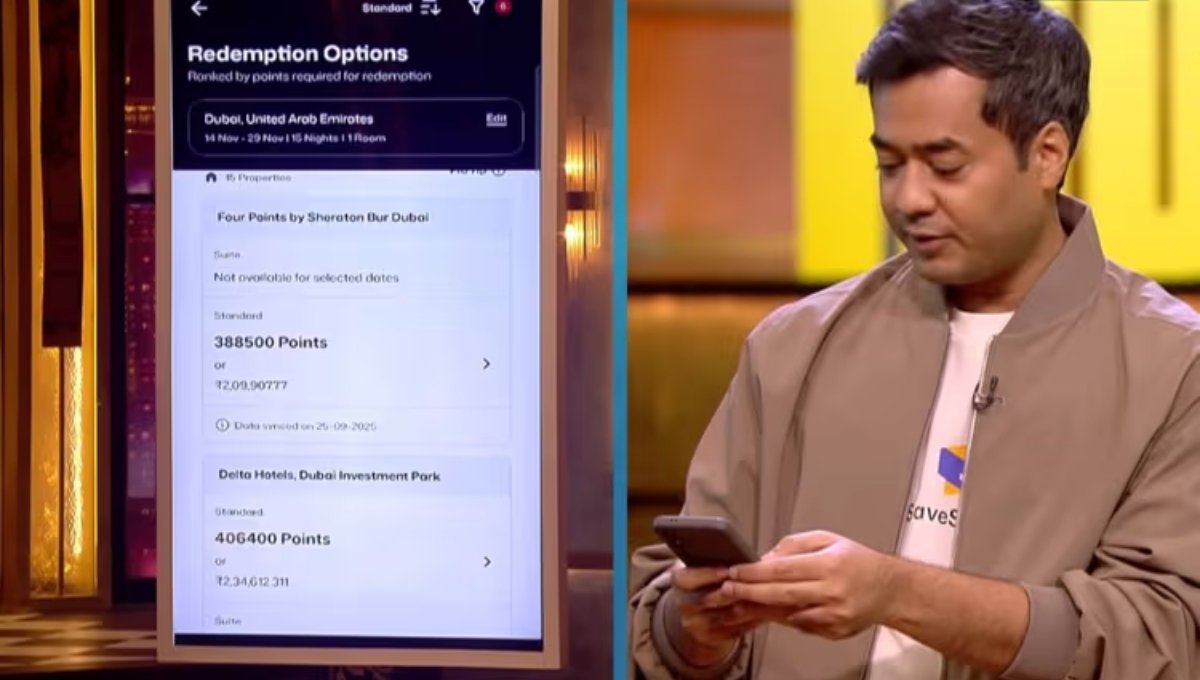

Shark Tank India: SaveSage Wins ₹4 Crore Funding With Smart Credit Card Rewards Idea

RBI Report: Why India’s State Fiscal Deficit Rose to 3.3% of GDP

PM Modi Distributes: 61,000 Job Letters at Rozgar Mela, Highlights Global Opportunities