Thus, in this kind of a scenario where almost all the banks are growing their credit card businesses at a very fast pace, Kotak Mahindra Bank situation may look somewhat different.

According to recent news reports, it has been found that the bank’s credit card business is facing a continuous decline. Yet, at the same time, Kotak Mahindra Bank’s CEO, Ashok Vaswani, remains absolutely confident that this situation would improve in the future.

Why is the credit card business at Kotak Bank declining?

The organization, namely Kotak Mahindra Bank, has been experiencing a decrease in its credit card users on a consistent basis. The most prominent cause of this phenomenon is comprised of regulatory hurdles faced by the bank, resulting in the slowing down of the process of giving out newly issued credit cards by the bank itself.

Furthermore, this decline is not sudden; rather it has been noticed in the last few quarters. However, in spite of this decline, the bank has not compromised on its service quality and risk management strategy, which may be beneficial for its long-term growth scenario.

Why is the CEO still so confident?

The chief executive officer of Kotak Mahindra Bank, Ashok Vaswani, termed this a phase, which is temporary in nature. He said that henceforth, the bank has focused entirely on strengthening its internal processes, and once all the necessary approvals are received, the credit card business will regain momentum.

He has also indicated that customers are gradually returning, and the bank started receiving positive signals in the coming months. He says focusing on quality growth is the priority of the bank and not mere increase in numbers.

What does this portend for the market?

The credit card business has become a big revenue source for banks today. In this context, Kotak certainly appears to be lagging behind. Experts argue that caution could prove salutary in the long run.

While many banks are busy issuing cards in huge numbers, Kotak is building a solid foundation while keeping risks at low levels. This may help them stay away from future problems such as defaults and NPAs.

What does this mean for investors and customers?

This also implies a message for investors, as it may not look promising now, but the bank’s vision is long-term. For customers, it is always desirable to know that the bank is not compromising on quality. However, if everything goes according to plan, then Kotak’s credit card business could return strongly again in the future.

Disclaimer: In this article, the writer has relied upon the publicly availed facts and news. One should only use the provided facts. One should seek expert advice before making any decision. Investment is risky, and one should never be held responsible by the author or the website.

Also read:

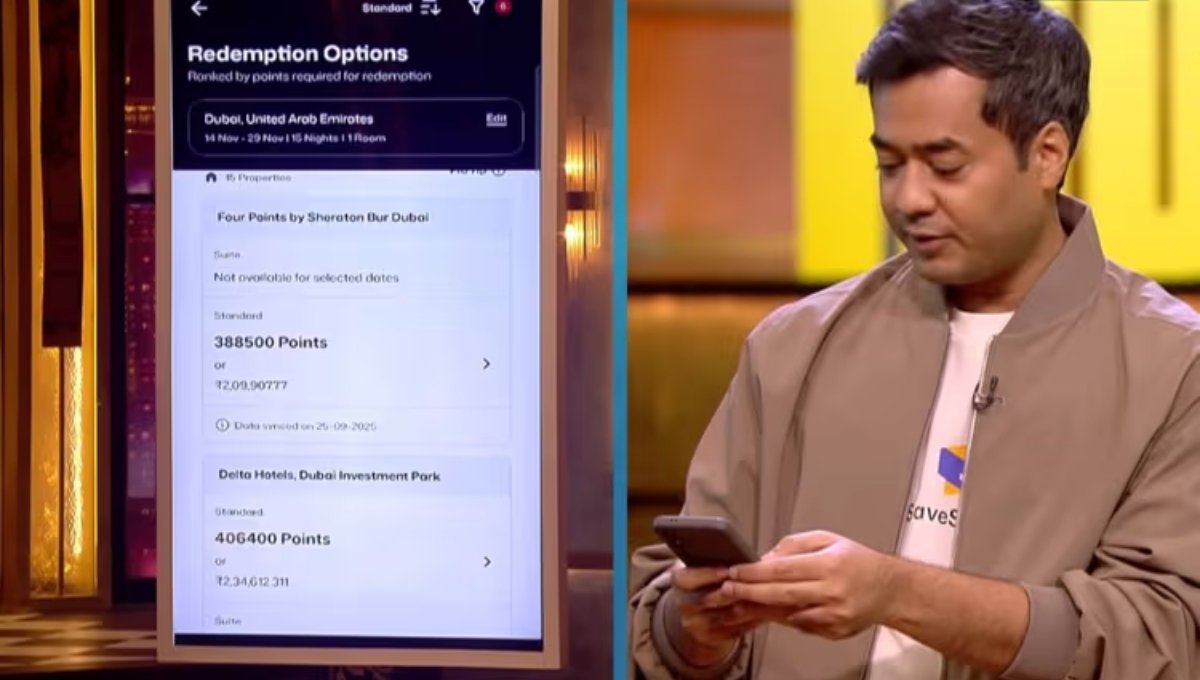

Shark Tank India: SaveSage Wins ₹4 Crore Funding With Smart Credit Card Rewards Idea

RBI Report: Why India’s State Fiscal Deficit Rose to 3.3% of GDP

PM Modi Distributes: 61,000 Job Letters at Rozgar Mela, Highlights Global Opportunities